Cambridge Centre for Risk Studies (CCRS) has just completed a two year exercise documenting all the different types of insurance that are available in the market and a classification system for all the assets that they protect. This has been published as a data definitions document v1.0 – a standardized schema for insurance companies to have a consistent method of evaluating their exposure – that will soon be available from our website.

This project, in collaboration with sponsor Risk Management Solutions, Inc., (RMS), involved extensive interviews with 130 industry specialists and consultation with 38 insurance, analyst, and modelling organizations.

The data definitions document will enable insurance companies to monitor and report their exposure across many different classes of insurance, which globally today covers an estimated $554 trillion of total insured value. The data standard will improve interchanges of data between market players to refine risk transfer to reinsurers and other risk partners, reporting to regulators, and exchanging information for risk co-share, delegated authority, and bordereau activities.

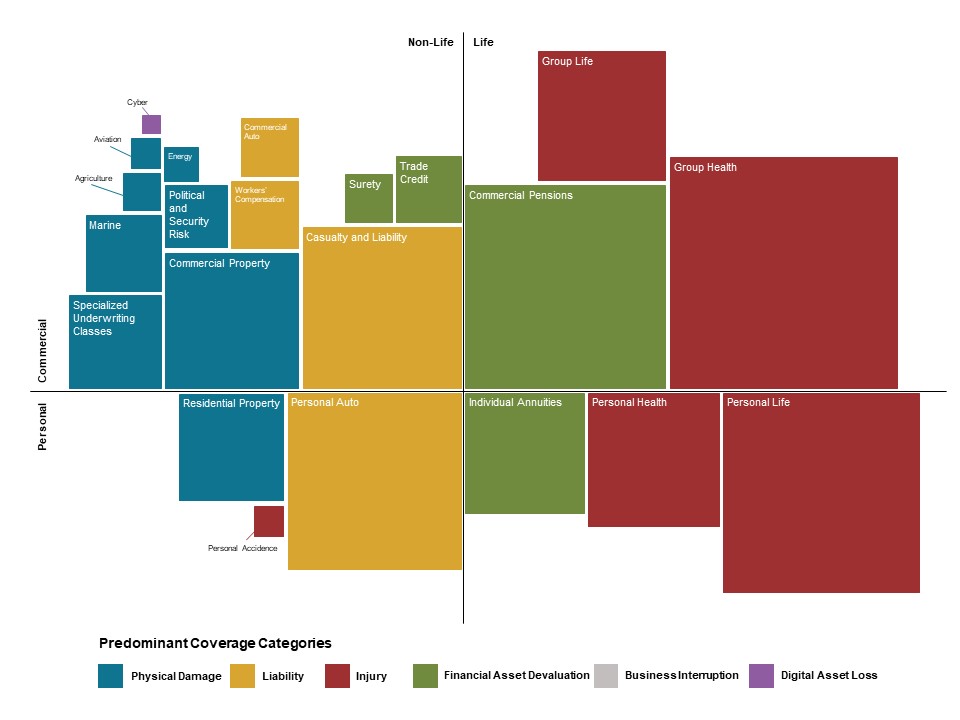

A key point of developing the data schema is to identify concentrations of exposure, and to assess accumulation risk by enabling new types of loss models. Insurers are concerned about several ways that accumulations can occur – through having multiple insurance policies with the same policyholder, having different lines of insurance with clusters of insured value in the same geographical location, and by having ‘clash’ risk from underlying events that impact several classes of insurance in an insurer’s portfolio.

The project has demonstrated the usefulness of the data definitions document in providing a framework for loss modelling by developing three catastrophe scenarios: a severe hurricane hitting the energy fields and marine installations in the Gulf of Mexico; an influenza pandemic that hits life and health insurers, as well as causing financial losses to the economy and stock markets; and a geopolitical conflict located in Southeast Asia that triggers losses across all the major classes of insurance. Insurance companies are now assessing the clash risk from these scenarios for the portfolios of multiline exposure that they manage.

6 September sees a gathering of many representatives of insurance companies, regulators, market associations, rating agencies, modellers, and academics for the launch of the data schema and the publication of the project report at a conference in Cambridge.

The data definition document v1.0 is published and is currently being implemented internally by members of the project steering committee and will be made available by RMS in their platforms and products. The hope is that the availability of the data definitions document will enable a new generation of risk model development and improvements across the insurance market in the ability to manage their multiline exposure risk. Feedback on the project outputs are welcomed.

Publications

Cambridge Centre for Risk Studies, 2018; Multi-Line Insurance Exposure Management: Data Definitions Document v1.0; in collaboration with Risk Management Solutions, Inc.; Sept 2018.

Cambridge Centre for Risk Studies, 2018; Challenges and Solutions for Enterprise Exposure Management; Report on project on Global Exposure, Accumulation and Clash, in collaboration with Risk Management Solutions, Inc.; Sept 2018.

These are available for download on our website.

Leave a Reply