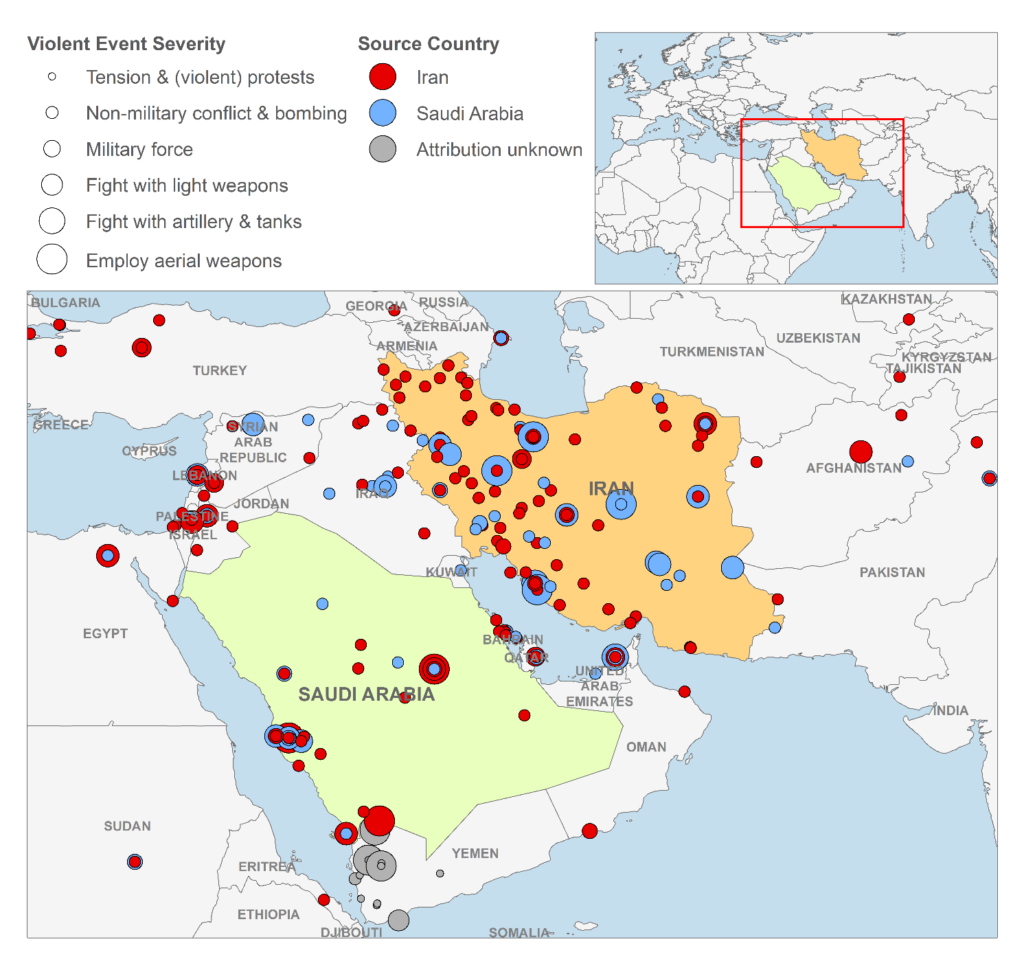

A suspected missile attack against Saudi Aramco holdings in northern Saudi Arabia on the morning of Saturday, 13 September has further enflamed geopolitical tensions in the region. Saudi Aramco is a strategically-vital pillar of industry for the kingdom and important to the global energy market as a whole.

The incident pulls together several risk trends which have dominated the area for decades. The attack was initially thought to be carried out by Iran-aligned Houthi insurgents operating in northern Yemen, who have acquired destructive ‘suicide’ drone strike technology. The precision of the attack, however, has led the US to attribute the strike to the Iranian military. US President Donald Trump’s sabre-rattling tweets about the attack may lead to an escalation in the ongoing stand-off between the US and Iran. The disruption caused by the attack and its ongoing clean-up at the Abqaiq processing facility has halted the production about 5 million barrels a day – 5% of global crude production.

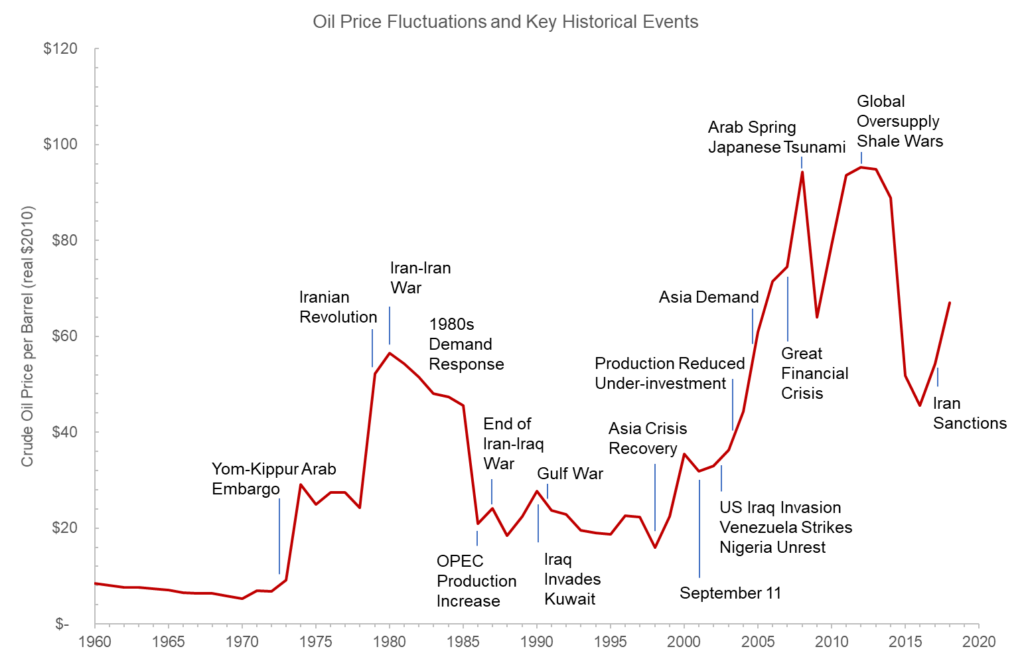

The shock to crude supplies has already seen prices surge by 20%, an almost thirty-year record, peaking at $77/barrel. Saudi Arabia has reassured customers that recovery from the attack will be rapid, with crude supplies returning to normal. Aramco has increased its production in offshore fields to patch the shortfall. The US has pledged some of its own reserves to cover supply shortages. The extent of the damage to the Abqaiq facility and the time needed to repair its equipment is not yet public.

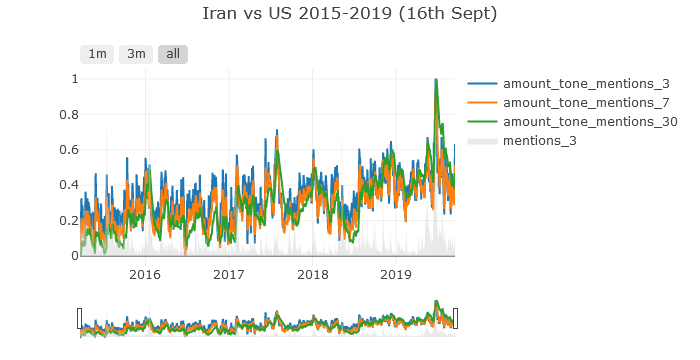

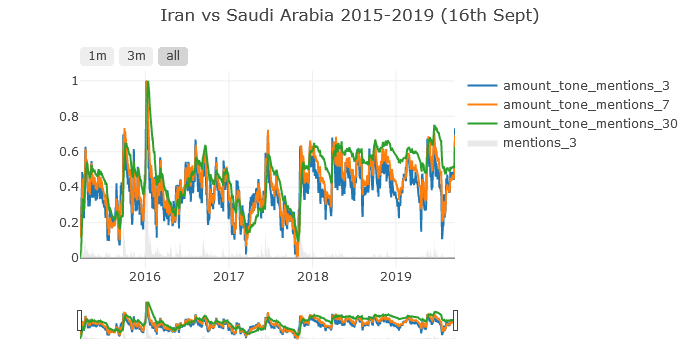

The Cambridge Centre for Risk Studies maintains several indicator trackers specific to a Middle East conflict, and to conflict between the US and Iran, which track closely with fluctuations in the price of oil.

Source: Cambridge Centre for Risk Studies Indicator Trackers

Source: Created by Cambridge Centre for Risk Studies using data from World Bank, Luciani (2011), and Bchir and Pedrosa-Garcia (2015)

A new suite of scenarios features an expansive set of variables exploring the impacts of an extended crisis in the region. Given the belligerence between the US and Iranian representatives following the attacks on Saudi Aramco, the likelihood of a military strike is now significantly higher since Saturday’s attack. In the standard version of this scenario, oil prices rise to $150/barrel. In the most extreme and unlikely version of events, oil prices peak at $300/barrel.

| L | Scenario Variant | Peak Oil Price WTI | Duration | Chance |

| L1 | Saudi Arabia-Iran War | $150 | 6 Months | Significant

Chance |

| L2 | US Coalition Invasion | $200 | 1 Year | Moderate

Chance |

| L3 | Multi-State Conflict | $250 | 2 Years | Highly

Unlikely |

| L4 | Regional Conflagration | $300 | 5 years | Remotest Possibility |

It is necessary to understand what the impact of a renewed US military intervention in the Middle East would mean private businesses across the globe. A forthcoming report from the Centre in partnership with IRM, Scenario Applications: Stress Testing Companies in the Energy Value Chain, examines in part how this scenario and its variants would impact the energy sector. Given the general dependency on energy consumption as a basic function of business, the impacts to the energy sector in the case of a prolonged conflict in the area would be reverberated around the private sector. The Centre estimates the impact of loss breakdowns for companies in the scenario.

The effects of the conflict scenario are largely felt in the reduction in output value, with lost output from the Middle East region, and a significant increase in capital expenditure required for replacement and reinvestment elsewhere.

With tensions between the US and Iran fraying and the continuing conflict in Yemen souring relations on both sides of the Middle East, understanding the real effects of a shock to the energy market and the chain of accumulative risk to the private sector is extremely important for almost all businesses.

The Cambridge Centre for Risk Studies incident trackers and scenario applications will be made available in October.

Leave a Reply