The art of financial network science, part II

The second annual Financial Risk & Network Science seminar was held on September 9 at the University of Cambridge Judge Business School, in partnership between the Centre and Risk Journals. As with last year, there was a great display of … Continued

Where does cyber risk accumulate for insurers?

“Taxonomy is described sometimes as a science and sometimes as an art, but really it’s a battleground.” ― Bill Bryson, A Short History of Nearly Everything After attending a cyber-risk accumulation workshop with a variety of cyber risk underwriters, I … Continued

Opening Pandora’s box: using city-scale risk models to quantify the global cost of catastrophes, and the value of resilience

In the Cambridge Centre for Risk Studies we have developed a framework to quantify the potential damage from a Pandora’s box of all ills – a comprehensive taxonomy of catastrophes. The methodology and outputs speak directly to the value of … Continued

Welcome to the boardroom: have Chief Risk Officers become too prominent?

While participating in this year’s Aspen Critical Issues and Risk Forum, I had the opportunity to hear from a number of non-executive board members on the pressing challenges facing public boards. The theme of the forum addressed effective board governance … Continued

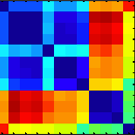

Eurobond Correlation Network: a case history

During the last two decades, the European sovereign bond market has been driven not only by the converging mechanism of its common currency, but by the centrifugal forces of trade imbalances and unequal sovereign credit capacity also. The Eurozone government … Continued

Eurobond Correlation Network: fearing the Grexit

Over the last five years, fears over a Greek debt and a financial contagion spreading to PIGS countries have dominated Euro Bond markets. Looking into 10 year bond price correlations across the same period, we are able to observe that, … Continued

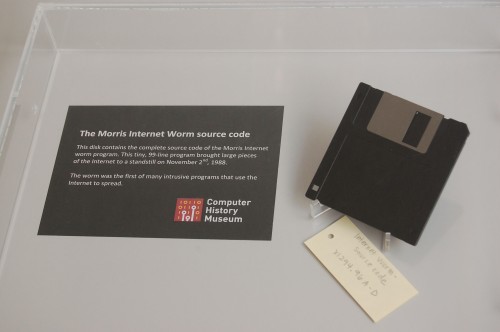

The emergent white-blood cells of the internet

I attended the 27th Annual FIRST conference in Berlin recently. I have attended regularly for the last four years, and this year I noticed a couple of important things. Firstly, if you’ll forgive the pun, there was an increase in … Continued

Differentiating two cyber risks

Traditional insurance practice involves insulating the insurer’s operational risks from the risks they are insuring. This means that maritime shipping insurance companies don’t place their headquarters aboard ships. Those that insure floods don’t have offices in floodplains. Usually, it’s geography that … Continued

The fossil fuel divestment campaign: what role does it play in addressing emerging carbon risk?

The emerging carbon risk Carbon risk is systemic in nature. Tied to the future availability of carbon assets and triggered by environmental-related risks, the risk of a carbon “bubble” collapse has the potential to cause large fossil fuel companies (coal, … Continued

Interstate conflict is the new top concern for Global Risks 2015

The WEF Global Risks 2015 identifies ‘interstate conflict’ as the top catastrophe threat of concern, in a new ranking order of business risks for the next decade. Managing the business risk posed by political instability and other threats is a … Continued